- Bonds are having one of their worst years ever amid high inflation and Fed tightening.

- But the assets are due for a rebound next year, many say.

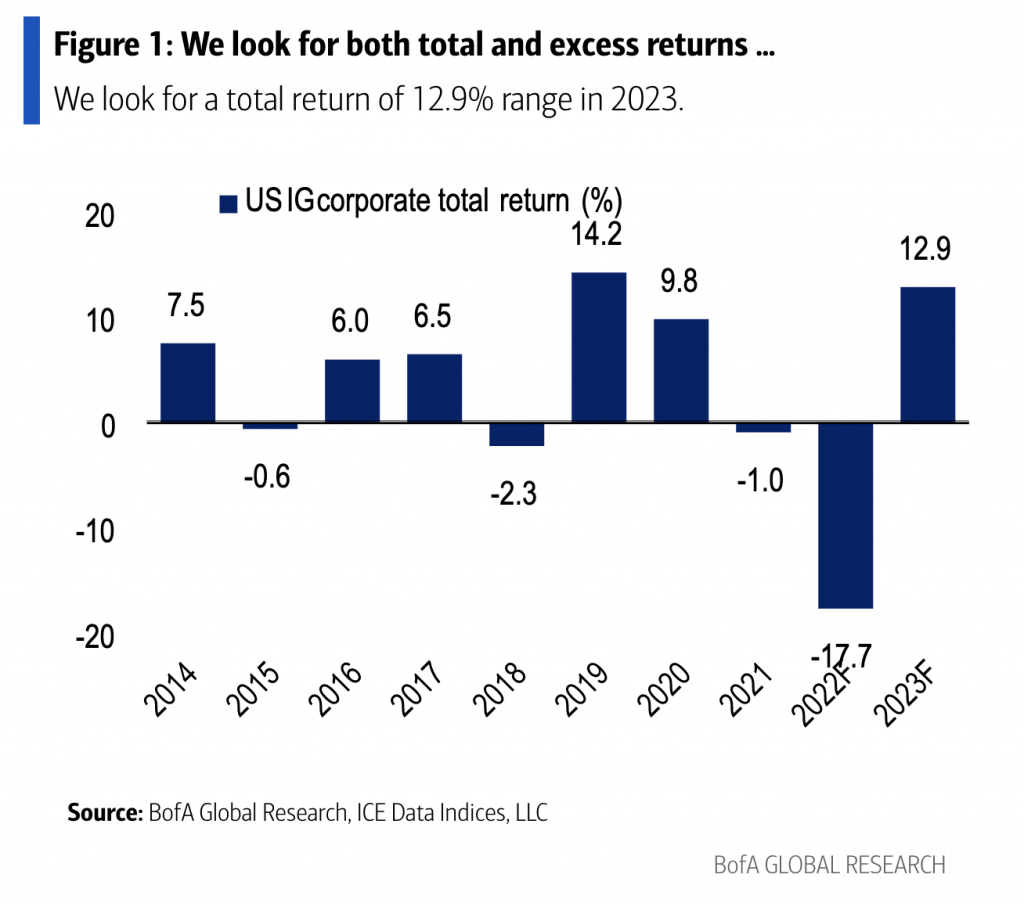

- In a recent note, Bank of America shared one area of the market they see returning 13%.

Bonds, like stocks, are having a terrible year.

As the Federal Reserve zealously tightens monetary policy to curb the highest inflation seen in four decades, bond prices have fallen and yields have soared. Yields on the benchmark 10-year Treasury note recently surpassed 4%, their highest level since 2007.

Corporate credit has also underperformed. The Bloomberg US Credit Index is down almost 17% in 2022.

But as inflation begins to come down — allowing the Fed to presumably start ratcheting down its torrid pace of tightening — and as investors fear that a recession is ahead, bonds are widely expected to reverse course in 2023.

Bank of America Credit Strategist Yuri Seliger also subscribes to this view. In a note to clients on Monday, Seliger said investment-grade corporate credit in particular is in for a big year. Investment-grade corporate bonds are those rated Baa by Moody's and BBB by S&P and Fitch because they're deemed to have low default risk. General Motors and CVS Health are among the firms that fit this bill.

Seliger said he expects this area of the market to return about 13% next year. Two driving forces underpin his call.

First, rates are expected to fall.

With the Consumer Price Index's year-over-year readings now declining for three straight months, inflation appears to be on the decline. A continued descent in inflation would allow the Fed to back off of hawkish policy, and allow Treasury rates to settle as well. Yields on 10-year notes have already started falling significantly since October's inflation reading was seen as favorable by investors last week.

But the amount of tightening that has taken place so far has some investors worried that a recession lies ahead. Companies are already starting layoffs or are instituting hiring freezes, and consumer spending in starting to cool. In a recession, investors tend to flock toward safehaven assets like Treasurys or high quality credit, causing their prices to rise and yields to fall.

Second, Seliger said credit spreads — the difference in yield between Treasurys and investment-grade corporate bonds of the same duration — are going to narrow. In other words, relative demand for investment-grade credit will outpace that for Treasurys. That's despite expectations that the 10-year Treasury yield will continue to decline.

While bond investors' top concern is recession, according to the latest monthly survey by Bank of America, the positive outlook for high quality credit relative to Treasurys suggests investors believe the economic situation will improve. Credit spreads tend to widen if a recession comes to pass as investors pile into risk-free Treasurys and demand higher relative yield from corporate bond issuers for taking on a higher risk.

"We expect the spread on ICE BofA US IG corporate index to tighten to 130bps in six months, and we assume the same spread for year-end 2023 as well," Seliger said. "This base case scenario implies a +12.9% total return and +379bps excess return for IG corporate bonds in 2023. This would be a big reversal from the expected -18% total return and -257bps excess return in 2022."

Foto: Bank of America

Bank of America's November survey of bond investors showed that both high yield bond investors and investment-grade bond investors expect BBB-rated bonds to outperform most relative to Treasurys in 2023.

Guggenheim Partners Global CIO Scott Minerd also recently told Insider that he expects investment-grade corporate bonds to be a top performer from here as they're historically cheap relative to Treasurys, and long-term interest rates are unlikely to climb much higher.

"That's a much better place to go with your money than the stock market," Minerd said in a November 2 interview.

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) are two ways to gain exposure to investment-grade corporate bonds.